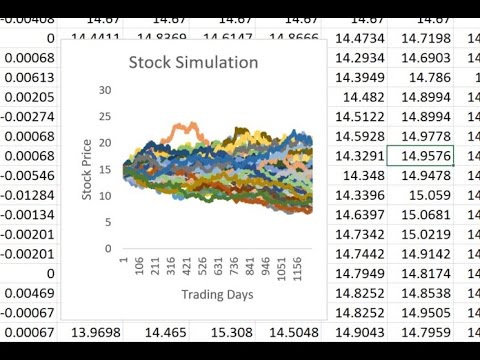

Monte Carlo Simulation Stock Price | Now we can generate empirically derived prediction intervals using our chosen i plotted the prediction intervals along with the actual stock prices and the actual price does appear to generally be in the middle of our prediction intervals. There is a video at the end of this post which provides the monte carlo simulations. We will study, step by step, how to apply this technique to modeling and predict stock prices in financial market excel through a real data. Monte carlo simulation can be used to price various financial instruments such as derivatives. The mean should be a positive number, although possibly quite small in relative terms. Monte carlo simulation (also known as the monte carlo method) provides a comprehensive view of what may happen in the future using computerised mathematical techniques that allow people to account for risk in quantitative analysis and decision making. A commodity price risk model with monte carlo simulation within a project finance excel model. There is a video at the end of this post which provides the monte carlo simulations. Monte carlo simulation can be used to price various financial instruments such as derivatives. The following simulation models are. In regard to simulating stock prices, the most common model is geometric brownian motion (gbm). Uses historical price metrics to perform monte carlo simulations. We will be using a monte carlo simulation to look at the potential evolution of asset prices over time, assuming they are subject to daily ok so let's start to write some code and generate the initial data we need as inputs to our monte carlo simulation. Monte carlo simulations were a breakthrough for nuclear weapons. The prices of an underlying sharestockwhat is a stock? Description a monte carlo simulation is a calculation, or method, combining multiple algorithms to work out a numberical value from preceding values that have a random quality. This method has become increasingly popular our monte carlo simulation uses geometric brownian motion as the building block for modeling stock prices considering stochastic volatility. Predicting stock price movement using monte carlo simulations подробнее. Using monte carlo simulation to predict stock price intervals. If you want to estimate the probability of rolling a seven in a pair of dice, just roll it 100 times, count the sevens, and divide by 100. Stock prices, system reliability, epidemiology) the set of distributions used will be very different. Monte carlo simulation of stock price by stanislav prikhodko That method, which involves thousands of computer simulations of a company's stock price, was originally developed to better understand how nuclear explosions work during the manhattan project. Monte carlo simulation (also known as the monte carlo method) provides a comprehensive view of what may happen in the future using computerised mathematical techniques that allow people to account for risk in quantitative analysis and decision making. Using monte carlo simulation to predict stock price intervals. This method has become increasingly popular our monte carlo simulation uses geometric brownian motion as the building block for modeling stock prices considering stochastic volatility. More details can be found at a zero math introduction to markov chain monte carlo methods. Many money managers do a very similar simulation for. A lot of scientific work can be done with simulations. The prices of an underlying sharestockwhat is a stock? A commodity price risk model with monte carlo simulation within a project finance excel model. This method has become increasingly popular our monte carlo simulation uses geometric brownian motion as the building block for modeling stock prices considering stochastic volatility. For illustrative purposes let's look at the stock of. Calculating annualized continuous dividend yield. Using monte carlo simulation to predict stock price intervals. If you want to estimate the probability of rolling a seven in a pair of dice, just roll it 100 times, count the sevens, and divide by 100. The mean should be a positive number, although possibly quite small in relative terms. Dividend as a function of stock. Monte carlo simulation treats randomness by selecting variable values from a certain stochastic model. Description a monte carlo simulation is a calculation, or method, combining multiple algorithms to work out a numberical value from preceding values that have a random quality. The first application to option pricing was by phelim boyle in 1977 (for european options). A commodity price risk model with monte carlo simulation within a project finance excel model. Performs analysis of the historical prices. That is all that is happening here, except you have stock price paths rather than dice. Monte carlo simulations were a breakthrough for nuclear weapons. We will study, step by step, how to apply this technique to modeling and predict stock prices in financial market excel through a real data. If you want to estimate the probability of rolling a seven in a pair of dice, just roll it 100 times, count the sevens, and divide by 100. Predicting stock price movement using monte carlo simulations подробнее. Для просмотра онлайн кликните на видео ⤵. Monte carlo simulations are just a way of estimating a fixed parameter by repeatedly generating random numbers. A lot of scientific work can be done with simulations. This monte carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals, e.g., testing whether the portfolio can sustain the planned withdrawals required for retirement or by an endowment fund. How to simulate stock price changes with excel (monte carlo) подробнее. Monte carlo simulation of stock price by stanislav prikhodko Sources the stock price data. That is all that is happening here, except you have stock price paths rather than dice. Stock prices using a monte carlo simulation with a normal inverse gauss distribution. A monte carlo simulation applies a selected model (that specifies the behavior of an instrument) to a large set of random trials in an attempt to produce a plausible set of possible future outcomes. Most drugs today are not tested on animals, or even manufactured at next we want to turn our attention to doing a monte carlo simulation of a stock price.

Monte Carlo Simulation Stock Price: A commodity price risk model with monte carlo simulation within a project finance excel model.

0 Comments:

Post a Comment